5 Investment Strategies for Beginners

5 Investment Strategies for Beginners

Investment is a strategy of making more money from your money. However, if you’re a beginner, the whole concept can feel quite daunting. The financial world is full of terminologies and concepts that can confuse new players. However, fear not! In this article, we’ll break down five simple investment strategies that can guide you on your journey to financial prosperity.

1. Diversify Your Investments

Diversification is one of the most basic and efficient investment strategies. It involves spreading your money across various investment types (stocks, bonds, real estate, etc.) to reduce risk. The theory is that if one investment performs poorly, the others may perform well and offset the loss. This way, you can take risks without the possibility of losing all your money.

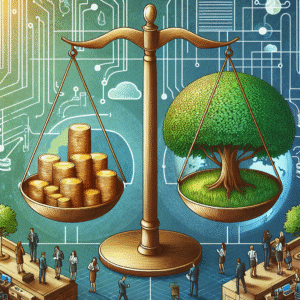

2. Set Long-Term Goals

Investing is not a way to get rich quickly; it’s a long-term strategy. Set realistic and clear goals before you start investing. Whether it’s saving for retirement, down payment for a home, or your child’s college education, having a goal will help you know how much capital you need and how long it will take to achieve it. This strategy aids you to resist the temptation of short-term high-risk investments if they don’t align with your long-term objectives.

3. Know Your Risk Tolerance

Risk tolerance refers to your willingness and capacity to lose money in exchange for potential significant gains. An aggressive investor, for instance, is willing to risk a lot of money for the potential of a higher reward. A conservative investor, on the other hand, prefers safer investments with lower but more predictable returns. Know where you fall on this spectrum and invest with your risk tolerance in mind.

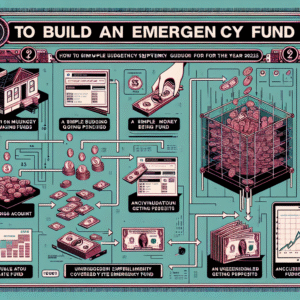

4. Keep an Emergency Fund

Before diving into the world of investment, ensure you have saved enough money to cover at least 3-6 months of your living expenses. Investment always carries a certain amount of risk and uncertainty. If things go awry, an emergency fund will reassure you that you can survive financially while finding other investment strategies that work for you.

5. Regularly Review and Adjust Your Investment

Making an investment is not a one-and-done deal. It would help if you revisit your investment portfolio periodically to ensure it aligns with your objectives and risk tolerance. The investment market’s dynamic nature might cause the balance of your portfolio to shift. For instance, if a particular stock you invested in performs very well, it might take up a more significant percentage of your portfolio than you initially intended. Make adjustments to rebalance your portfolio as needed.

Investment is a critical step towards achieving financial freedom and security. However, as a beginner, it’s essential to take time understanding the ins and outs of this new venture. These five strategies are not exhaustive but provide you a great starting point. Remember that investing is a marathon, not a sprint. Be patient, maintain discipline, and the magic of compounding will do wonders for your financial health.

* The post is written by AI and may contain inaccuracies.