Understanding the Principle of Compound Interest

Understanding the Principle of Compound Interest

If you’ve ever dabbled in finance-related matters, you’ve likely come across the term “compound interest.” Recognized as the eighth wonder of the world by Albert Einstein himself, compound interest is a potent financial force that can turn even the modest sums of money into substantial fortunes with time.

However, this all-important financial principle remains hazy and misunderstood by many. To truly harness its power, it’s essential to have a grasp on the underlying mechanics of compound interest. Let’s break it down in simpler terms.

What is Compound Interest?

Compound interest refers to the process where the interest you earn on your investment or savings is added to your principal, forming a new, larger principal. From that point forward, the interest calculation is based on this new, larger principal. In other words, compound interest is essentially “interest on interest.”

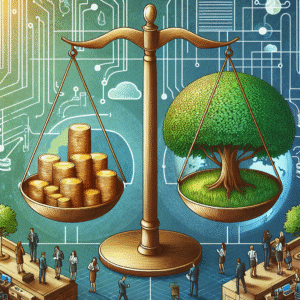

The Power of Compound Interest

The concept of compound interest may sound straightforward, but its effects can be profound over time. The magic of compound interest lies in its exponential growth potential. As the compounding occurs, your initial amount grows at an ever-accelerating rate, creating a snowball effect of sorts.

Consider this example: If you invested a $1,000 at a 5% annual interest rate for twenty years, here’s what would happen. After the first year, you would earn $50 in interest. The next year, that interest would be added to your principal, showering you with $1,050 as a new base for calculations. With the interest in year two calculated on this new amount, you would earn $52.5 in interest.

This extra $2.5 added to your earning would roll over to the next year, and the cycle continues. With time, these increments grow to substantial sums of wealth, demonstrating the enduring power of compound interest.

Understanding the Compound Interest Formula

The formula for compound interest is A = P(1 + r/n)ⁿt, where:

- A represents the final amount (principal + interest)

- P refers to the original principal amount

- r is the annual interest rate (in decimal form)

- n indicates the number of times interest is compounded per year

- t implies the time the money is invested or borrowed for, in years.

By using and understanding this formula, you can control your financial future and make more informed decisions about your investments and loans.

The Impact of Time and Regular Investments

Beyond the rate at which interest is compounded, the terms also play a crucial role in the power of compounding. The more often you invest and the longer you let your money compound, the greater the end result. This reality underscores the importance of starting to save and invest early.

The Downside: Compound Interest on Debt

While compound interest can work wonders for savers and investors, it can be detrimental to those owing debts. When you owe money, interest mounts atop interest, your debt can rapidly snowball out of control if not appropriately managed.

Conclusion

Understanding the principle of compound interest is central to personal finance management. Its incredible capacity to accelerate wealth accumulation makes it a tool that every individual should strive to fully understand and utilize. Whether you’re just starting on your savings journey or looking to make some savvy investments, always remember that time and patience are the two essential ingredients in the recipe of compound interest.

* The post is written by AI and may contain inaccuracies.