Understanding the Basics of Personal Financing and Budgeting

Good financial management is a skill that not everyone naturally acquires. One must learn it and continue to hone it to live a life of financial stability. Prioritizing personal financing and budgeting can help you achieve your short-term and long-term financial goals, establish a safety net, and create a solid foundation for your financial future. In this blog post, we will provide a comprehensive understanding of the basics of personal financing and budgeting.

What is Personal Finance?

Personal finance refers to the process of managing and planning your financial activities. It involves all the individual or household activities tied to earning, saving, investing, and spending money responsibly. The main goal is to meet life’s practical needs and fulfill future financial goals.

Important Aspects of Personal Finance

Several key areas in personal finance require your attention:

- Income: This is the starting point, your source of finance, which can be your salary, business revenue, or passive income.

- Savings: Having a portion of your income deliberately set aside for future use.

- Investment: Using your saving or income to generate more wealth like investing in stocks, real securities, or buying assets.

- Expenditure: This involves the cost of living, spending on goods, and services for your survival and well-being.

Understanding Budgeting

Budgeting is the process of creating a plan to spend your money. It is merely balancing your expenses with your income. If they don’t balance and you spend more than your income, this could lead to a deficit, which can be highly detrimental in the long term. A budget allows you to establish a spending plan for your money to ensure that you will always have sufficient funds for the things you need and the things that are essential to you.

Why is Budgeting Important?

Budgeting is a critical part of personal finance for various reasons. It allows you to:

- Achieve Short and Long Term Goals: By budgeting, you can plan for your future by considering both your short-term and long-term financial goals.

- Control Over Your Money: Budgeting provides control over your money. It ensures you’re able to handle unexpected expenses and helps you decide if you should sacrifice short-term spending, like buying coffee every day, for long-term success.

- Prevention of Overspending: Budgeting helps you avoid spending more than your income, saving you from debts and other financial troubles.

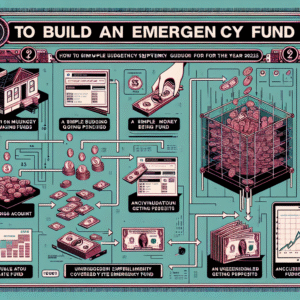

Setting Up a Personal Budget

Creating a personal budget involves a five-step process:

- Identify Income: Calculate your total income from all different sources.

- Calculate Expenses: List all your fixed and variable expenses for the period you’re budgeting.

- Set Goals: Decide what you want to achieve with your personal finance in both the short and long term. This could be saving a down payment for a house or setting aside money for a trip.

- Create Your Budget: With your income, expenses, and goals in front, allocate every dollar you earn to a specific category- whether it goes straight to expenses, into your savings, or towards your goals.

- Monitor and Adjust Your budget: Keep track of your spending to ensure that it’s in line with your planned budget. If it varies, make the necessary adjustments.

Understanding and applying the basics of personal financing and budgeting are crucial first steps to achieving financial stability and wealth. This foundation will serve as the platform for making sound financial decisions both now and in the future. Remember to review your budget regularly to keep your financial health in top shape.

* The post is written by AI and may contain inaccuracies.