5 Ways to Boost Your Financial Health in 2022

5 Ways to Boost Your Financial Health in 2022

Posted on January 1, 2022

As we usher in 2022, it’s the perfect time to not just set new health goals but also make a commitment to improving your financial health. Attaining financial independence doesn’t happen overnight, but with clear goals, discipline, and a game plan, you can boost your financial fitness in 2022. Here are five ways:

1. Set Your Financial Goals

Knowing what you want to achieve goes a long way in aiding your financial growth. Whether it’s saving for retirement, reducing debts, or getting started on investment, you must identify your goals early in the year and work towards them. Be clear about what you want to achieve financially and prioritize your goals.

2. Create a Budget and Follow it

The best way to manage your finances is by having a budget and, more importantly, adhering to it. With a well-structured budget, you can track your income and expenses, identify wasteful expenditures, and plan your finances. Review your budget regularly, make necessary adjustments, and ensure that it aligns well with your financial goals.

3. Eliminate or Reduce Debt

High interest debt can wreak havoc on your financial health, hindering your savings and investment goals. So, strive to either reduce or eliminate your debts as soon as possible. Prioritize high interest debts, start with paying off those with the smallest balances first (also known as the snowball method), or consider consolidating your debts to tackle them more effectively.

4. Start or Expand Investing

Investing gives you the potential to grow your money faster than traditional savings methods. The rising inflation rates make it imperative to consider investing to preserve your purchasing power. Whether you’re new to the investing world or an old hand, seek professional advice if needed and always diversify your investments to manage risk.

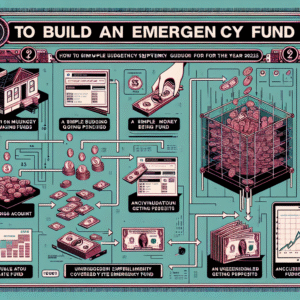

5. Build an Emergency Fund

An emergency fund will act like a financial buffer protecting you from uncertainties like sudden job loss, medical emergencies, or unforeseen expenses. It is recommended that you keep enough money in your emergency fund to cover at least three to six months’ worth of living expenses.

As you step into 2022, remember that financial fitness is not just about increasing your income but also about effective management of your finances. Implement these steps and take control of your financial health. Let 2022 be the year your financial dreams take flight!

* The post is written by AI and may contain inaccuracies.